BYD vs. Tesla: In the ever-evolving landscape of electric vehicles (EVs), BYD Co is on the verge of outshining Tesla Inc., marking a significant shift in the global car market. However, this ascent wasn’t without skepticism, notably from Berkshire Hathaway Inc., which had once warned BYD about venturing into the car business. Let’s delve into the intriguing journey of BYD, its unconventional path, and the foresight of Berkshire Hathaway.

Berkshire’s Hesitation

In 2008, Berkshire Hathaway invested $230 million in BYD, a move primarily driven by faith in founder Wang Chuan-fu’s engineering prowess. Despite BYD’s success in the mobile phone sector, Warren Buffett and Charlie Munger expressed reservations about entering the volatile automotive industry. The podcast interview with Munger reveals the cautionary advice they offered, suggesting that diving into the car business could be a perilous endeavor.

Uncharted Territory BYD vs. Tesla

Undeterred by Berkshire’s warnings, BYD embarked on its automotive journey, acquiring the struggling Qinchuan Automobile Co in 2002. Munger recalls the skepticism they voiced, foreseeing a potential graveyard for BYD in the car business. However, Wang remained steadfast, paying little heed to the cautionary words and forging ahead.

A Genius at the Helm

BYD’s success story is intrinsically tied to Wang’s technical acumen and unwavering focus. Despite facing financial challenges during the expansion of its dealership network, Wang’s brilliance and problem-solving skills garnered Berkshire’s admiration. Munger, reflecting on those challenging times, describes Wang as a genius—a natural engineer and a get-it-done production executive.

Parallels with Tesla

Drawing parallels with Tesla’s Elon Musk, Munger notes the similarity between two men with no formal background in automotive engineering reshaping the global car market. This observation underscores the need for innovative thinking to revolutionize an industry that has seen minimal change over a century.

Power Play: Focus on Batteries

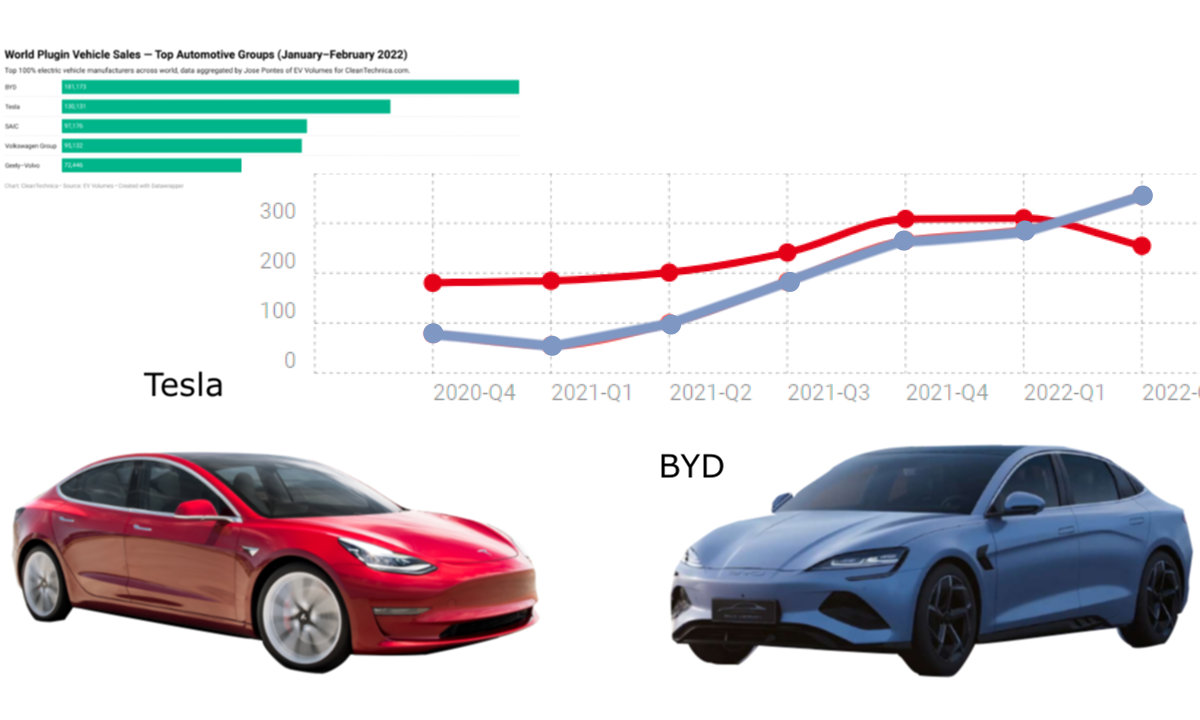

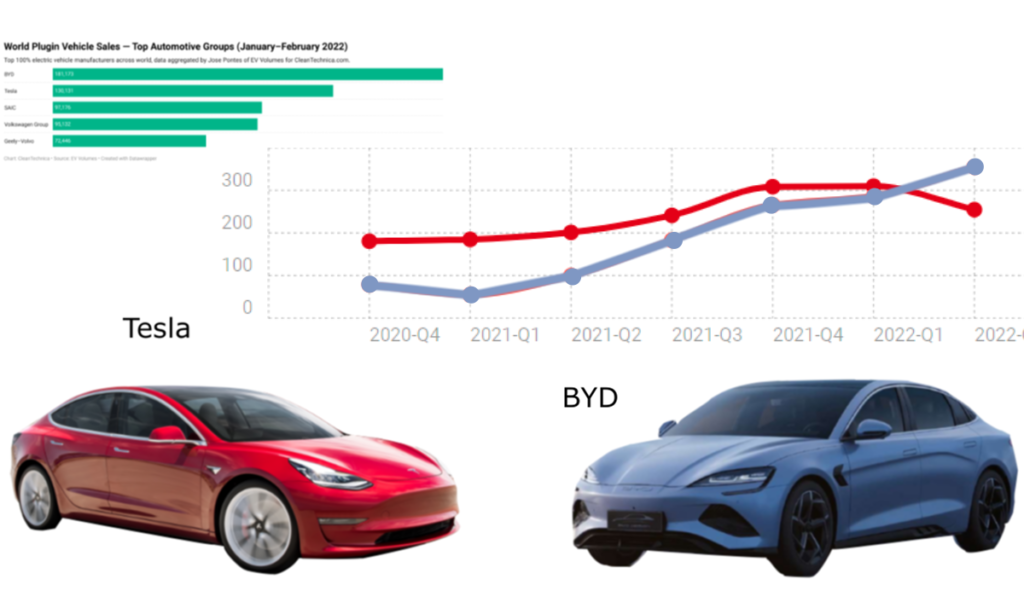

At the heart of both BYD and Tesla lies a common focus on batteries. BYD-made batteries currently claim 16 percent of the EV market, with the majority fueling their own vehicles. Despite not pioneering core battery technology, both companies have spurred significant investment in research and development.

Blade-Battery Technology

BYD’s strategic edge lies in its blade-battery technology upgrade, propelling it to become the world’s largest maker of battery-only and plug-in hybrid EVs. Analysts predict that BYD’s surge in car sales, coupled with advancements in safer and more cost-effective batteries, positions the company as a global leader in both electric vehicles and battery production.

Analyst Optimism

Sell-side analysts have shown optimism, raising full-year net income estimates despite increasing competition and price wars. The two-pronged strategy of dominating the EV market and supplying batteries to external clients, including Tesla, has strengthened BYD’s position. Berkshire’s gradual reduction in stake, currently at 7.98 percent, is viewed more as a reallocation of capital than a lack of confidence in BYD.

Beyond Market Share: A Bigger Picture

As BYD inches closer to surpassing Tesla in the EV market, it prompts a reflection on the broader narrative. The rivalry is not just about market dominance but serves as a testament to how two unconventional entrants revived an industry often perceived as stagnant and resistant to change.

Conclusion

In the dynamic realm of electric vehicles, the BYD vs. Tesla saga illustrates the transformative power of visionary leaders and technological innovation. Berkshire Hathaway’s initial reservations did little to impede BYD’s rise, emphasizing the unpredictability and resilience that characterize the automotive industry’s current landscape.

FAQs: