In today’s fast-paced world, financial emergencies can arise at any time. Whether it’s a medical bill, car repair, or unexpected home expenses, having access to quick cash can be a lifesaver. Next day personal loans are designed to provide a solution for such situations, offering a swift and convenient way to obtain the funds you need. In this article, we will delve into the world of next day personal loan reviews, exploring how they work, their benefits, the application process, and what to consider when choosing a lender.

What Is a Next Day Personal Loan?

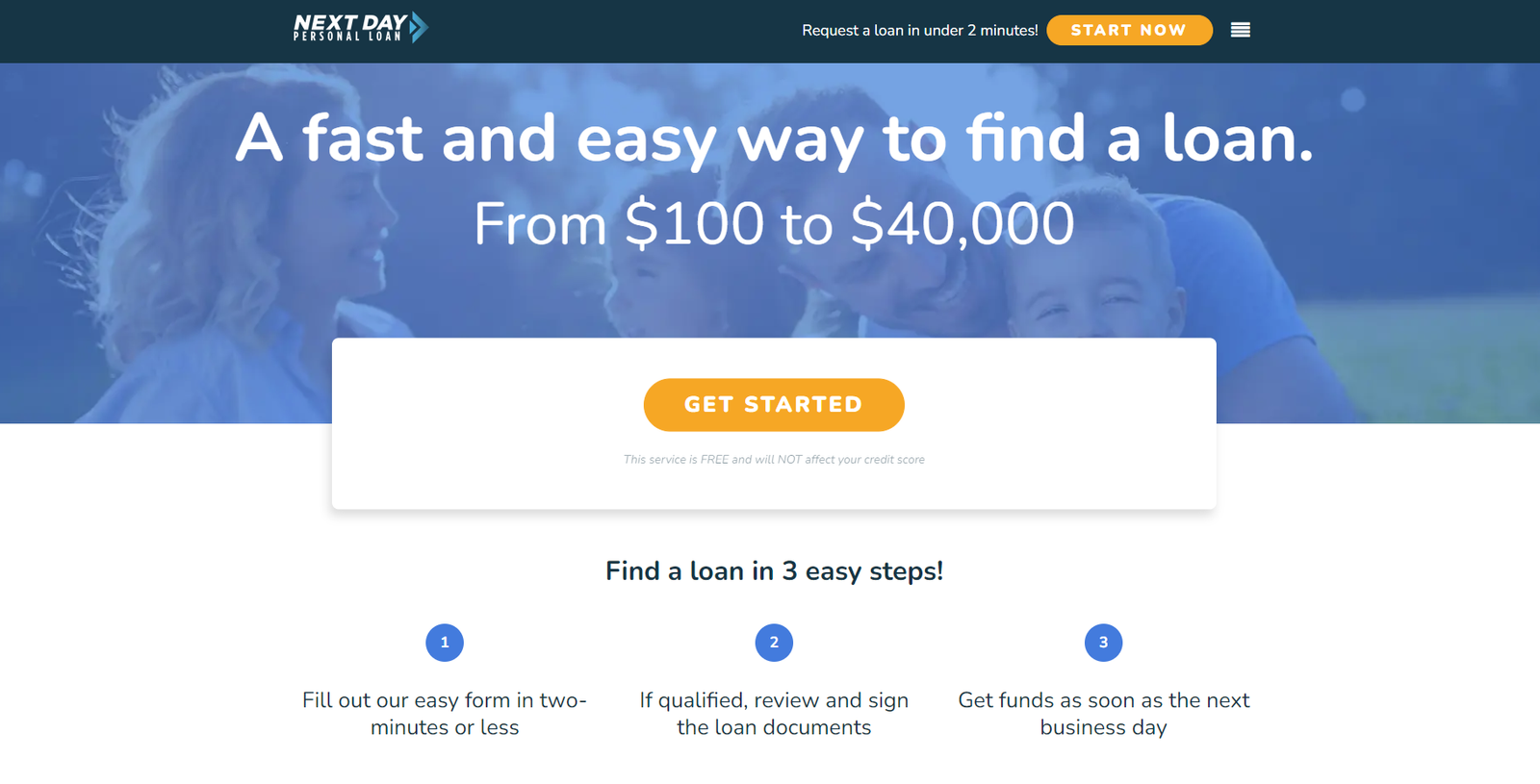

A next-day personal loan, as the name suggests, is a type of unsecured personal loan that provides borrowers with quick access to funds, often within 24 hours. These loans are typically small to medium-sized and can be used for a variety of purposes, including debt consolidation, medical bills, or other unexpected expenses. Unlike traditional bank loans, next-day personal loans don’t require collateral, making them an attractive option for those who need money urgently.

Why Consider a Next Day Personal Loan?

There are several reasons why next day personal loans are a popular choice for individuals facing financial challenges:

- Speed: Next day personal loans are known for their quick approval and funding process, ensuring that you get the money you need when you need it most.

- Convenience: The application process for these loans is often streamlined and can be completed online, saving you time and hassle.

- Flexibility: Borrowers have the freedom to use the funds for a wide range of purposes, providing financial relief in various situations.

How to Apply for a Next Day Personal Loan

The application process for a next day personal loan is straightforward. Here’s a step-by-step guide to help you get started:

- Research Lenders: Begin by researching reputable lenders that offer next-day personal loans. Compare their interest rates, fees, and customer reviews to find the best fit for your needs.

- Check Eligibility: Review the eligibility criteria of the selected lender to ensure you meet the requirements.

- Gather Documents: Prepare the necessary documents, which may include proof of identity, income, and bank statements.

- Complete the Application: Fill out the online application form with accurate information. Be sure to double-check for any errors before submission.

- Await Approval: After submitting your application, the lender will review your information and notify you of their decision.

- Receive Funds: Once approved, the funds will be deposited into your bank account within the next day.

Benefits of Next Day Personal Loans

Next day personal loans come with a host of benefits, including:

- Quick Access to Funds: These loans provide rapid solutions to urgent financial needs.

- No Collateral Required: You won’t need to risk your assets to secure the loan.

- Flexible Use: Borrowers have the freedom to use the funds as they see fit.

- Convenient Application Process: Online applications make the process hassle-free.

The Application Process

To ensure a smooth application process, it’s important to understand the following:

Eligibility Criteria

Lenders may have specific eligibility requirements, which can vary from one institution to another. Common eligibility criteria include age, income, and credit history. Be sure to meet these requirements before applying.

Interest Rates and Fees

Next day personal loans often come with higher interest rates compared to traditional loans. Additionally, there may be origination fees and other charges. Review these terms carefully to understand the overall cost of the loan.

Repayment Options

Discuss repayment options with the lender. It’s crucial to understand the terms and conditions, including the loan duration and monthly installment amount.

Pros of Next Day Personal Loans

Next day personal loans offer several advantages, such as:

- Emergency Funds: Ideal for unexpected expenses or emergencies.

- Quick Approval: Swift access to cash.

- No Collateral: You don’t need to risk your assets.

- Bad Credit Friendly: Some lenders cater to borrowers with less-than-perfect credit scores.

Cons of Next Day Personal Loans

While these loans have their benefits, it’s important to be aware of the potential drawbacks:

- Higher Interest Rates: Next-day personal loans typically come with higher interest rates.

- Shorter Repayment Period: The repayment terms may be shorter, resulting in higher monthly payments.

- Risk of Debt: If not managed responsibly, these loans can lead to debt accumulation.

How to Choose the Right Lender

Selecting the right lender is crucial for a positive borrowing experience. Consider the following factors when making your choice:

- Reputation: Look for lenders with a good track record and positive customer reviews.

- Interest Rates: Compare interest rates and fees to find the most affordable option.

- Customer Service: Ensure the lender provides excellent customer support in case you have questions or concerns.

- Transparency: A reputable lender should be transparent about their terms and conditions.

Next Day Personal Loan Reviews

Before choosing a lender, it’s essential to read next day personal loan reviews. These reviews offer insights into the experiences of other borrowers, helping you make an informed decision. Look for feedback on the application process, customer service, and overall satisfaction.

Success Stories

Here are a couple of success stories from individuals who used next-day personal loans to overcome financial challenges:

- Samantha’s Medical Emergency: Samantha faced a sudden medical emergency and needed funds for the treatment. She applied for a next-day personal loan, which provided her with the money she needed to cover the medical expenses. The quick approval and funding saved her from a difficult situation.

- Mike’s Car Repair: Mike’s car broke down unexpectedly, and he couldn’t afford the repairs. He opted for a next-day personal loan to get his car back on the road. The convenience and speed of the loan process allowed him to resume his daily activities without any disruption.

Conclusion

Next day personal loans are a valuable financial tool for those in need of quick and convenient access to funds. They offer a solution to unexpected expenses and emergencies. However, it’s crucial to choose a reputable lender, understand the terms, and manage the loan responsibly. Reading next day personal loan reviews can provide valuable insights into making an informed decision.