In the ever-evolving landscape of investments, the Tata Group stands out as a beacon of trust and success. With a history spanning 155 years, the group has consistently demonstrated a commitment to innovation and diversification. As of the financial year 2023, the total revenue of Tata Group companies has reached a staggering US$ 150 billion, a remarkable growth from the modest US$ 8.9 billion in the year 2000.

Tata Group’s Success in 2023

The year 2023 witnessed exceptional performances from Tata Group stocks. Notably, Tata Motors secured its position among the top three stocks with the highest returns in the Nifty 50 stocks, marking its third-best annual performance in the past two decades. Trent, another gem in the Tata portfolio, became the fifth Tata Group company to cross the Rs 1 trillion valuation milestone.

The Unveiling of Multibagger Stocks

After a triumphant year, it’s only natural to be curious about which Tata Group stocks delivered multibagger returns in 2023. Let’s delve into the top five multibagger Tata Group stocks that stole the show.

#1 Benares Hotels: A Hidden Gem

Benares Hotels, a lesser-known entity in the Tata Group, emerges as the first multibagger stock on our list. As a subsidiary of Indian Hotels (IHC), it operates under the Taj portfolio, running two hotels in Varanasi and a Ginger Hotel in Maharashtra. Boasting a remarkable 205% return in the last year, Benares Hotels witnessed a significant turnaround, doubling its revenue and achieving substantial growth in EBITDA and PAT.

The post-COVID period played a pivotal role in the company’s success, with a sharp revival in the Indian hospitality industry. The strategic brand association with Taj IHC further contributed to high revenue per available room (RevPAR). Benares Hotels, with impressive return ratios, almost zero debt, and a strong promoter holding, is set for expansion, exemplified by Taj Ganges’ plan to add a 100-room tower.

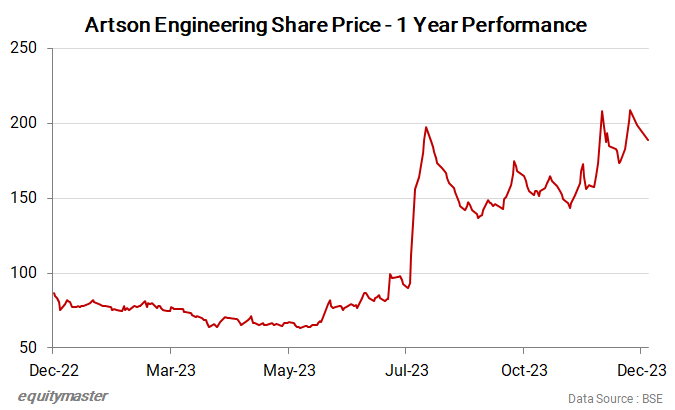

#2 Artson Engineering: Driving Growth in Hydrocarbons

Artson Engineering, a Tata Projects subsidiary, specializes in design, engineering, and construction for the oil & gas and hydrocarbon industry. With a substantial 144% return in the past year, the company faced challenges post-COVID due to fluctuating commodity prices. However, recent orders, including a significant one from Andritz Technologies, have bolstered its outlook.

The company envisions playing a role in India’s transition to cleaner energy, focusing on manufacturing key components for the evolving supply chain. Despite revenue challenges in the September 2023 quarter, Artson Engineering’s profitability improved, showcasing resilience and adaptability.

#3 Tata Technologies: The Power of Outsourced Engineering

The recently listed Tata Technologies secures the third spot on our multi-bagger list. Specializing in outsourced engineering services and digital solutions, the company has experienced a remarkable 144% surge in its share price since its listing. Despite being a new entrant, Tata Technologies serves over 35 traditional automobile OEMs and 12 new energy vehicle companies.

With a well-diversified revenue stream and impressive growth rates in revenue and profit, Tata Tech maintains high client retention. As it operates globally, with a strong presence in North America, Europe, and the Asia Pacific, the company’s future looks promising, though its reliance on Tata Motors and Jaguar Land Rover remains a consideration.

#4 Trent: Retail Success Story

Trent, a retail powerhouse offering a range of products under various brands, including Westside and Zudio, secures the fourth position. With a commendable 122% return in the past year, Trent reported robust revenue growth and increased customer traction. The Star brand, with 65 stores, witnessed a 30% operating revenue growth in the September quarter.

Despite challenging market conditions, Trent continues to expand its footprint, adding new stores across multiple cities. The company’s focus on diversification, coupled with the confidence expressed by Chairman Mr. Noel Tata, positions Trent as a compelling investment within the Tata Group.

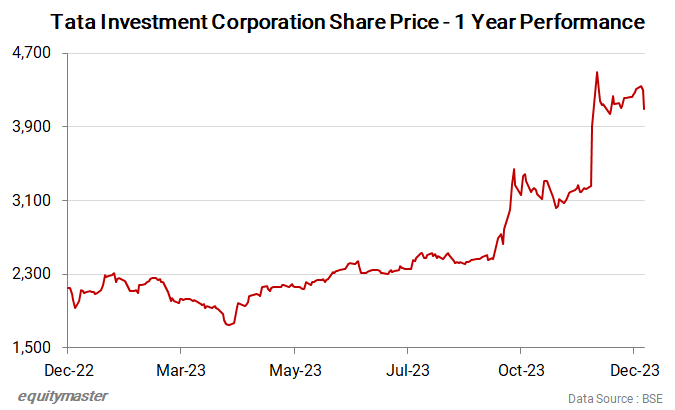

#5 Tata Investment Corporation: Navigating Finance with Success

The final entrant on our list is Tata Investment Corporation, a non-banking finance company engaged in long-term investments. With a noteworthy return of 104% in the last year, the company generates a significant portion of its income from dividends and interest.

In the recent September quarter, Tata Investment Corporation demonstrated a 30% increase in dividend income, reflecting the stability of its income sources. Almost debt-free with steady promoter holding, the company presents a steady option for investors looking for long-term stability.

Conclusion: Investing in Tata Group’s Legacy

The rich history, innovation, and substantial contributions to India’s growth make Tata Group stocks an attractive investment option. However, prudent investors must conduct thorough due diligence before making any investment decisions. Assessing a company’s fundamental strength is crucial for understanding its long-term potential.

For a comprehensive analysis of Tata Group stocks, including financial comparisons and fundamentals, refer to the compiled list provided. Happy investing!