As of January 17, 2024, the current share price of Infosys is ₹1,640.20. The 52-week high is ₹1,664.95, while the 52-week low is ₹1,185.30. The all-time high for Infosys shares was ₹1,953.90, reached on January 17, 2022. In 1993, Infosys went public and got listed on the Indian stock exchanges, and in 1999, it became the first Indian company to be listed on Nasdaq. Despite facing challenges, such as the 2008 financial crisis, Infosys has shown resilience and growth in its share price over the years.

Key Takeaways:

- Infosys share price has shown growth and resilience over the years.

- Infosys went public and was listed on Indian stock exchanges in 1993.

- In 1999, Infosys became the first Indian company to be listed on Nasdaq.

- Despite challenges like the 2008 financial crisis, Infosys has continued to perform well in the stock market.

- Infosys’ all-time high share price was ₹1,953.90 on January 17, 2022.

Infosys Share Price History and Performance

The table below showcases the historical share price of Infosys from 1993 to 2024. It provides an overview of the closing prices, yearly change percentage, and the highest and lowest prices for each year. This data gives valuable insights into the performance of Infosys in the stock market over the years.

| Year | Closing Price | Yearly Change % | Highest Price | Lowest Price |

|---|---|---|---|---|

| 1993 | ₹120.60 | NA | ₹142.80 | ₹86.50 |

| 1994 | ₹230.00 | 90.6% | ₹247.50 | ₹136.70 |

| 1995 | ₹367.50 | 59.8% | ₹380.00 | ₹230.00 |

| 1996 | ₹437.50 | 19.1% | ₹470.00 | ₹342.00 |

| 1997 | ₹1,140.00 | 160.5% | ₹1,320.00 | ₹437.50 |

| 1998 | ₹1,947.50 | 70.9% | ₹2,275.00 | ₹940.00 |

| 1999 | ₹9,883.75 | 407.8% | ₹9,883.75 | ₹1,947.50 |

| 2000 | ₹14,043.15 | 41.9% | ₹17,117.50 | ₹8,562.50 |

| 2001 | ₹5,528.25 | -60.6% | ₹15,098.75 | ₹5,528.25 |

| 2002 | ₹2,700.00 | -51.2% | ₹5,528.25 | ₹2,326.00 |

| 2003 | ₹5,678.75 | 110.7% | ₹6,685.00 | ₹2,394.00 |

| 2004 | ₹10,165.30 | 79.0% | ₹11,298.80 | ₹6,060.25 |

| 2005 | ₹4,309.80 | -57.7% | ₹10,165.30 | ₹2,560.05 |

| 2006 | ₹2,758.95 | -36.1% | ₹4,699.25 | ₹1,825.05 |

| 2007 | ₹3,444.55 | 24.9% | ₹3,515.25 | ₹2,273.75 |

| 2008 | ₹1,164.25 | -66.2% | ₹3,515.25 | ₹1,032.40 |

| 2009 | ₹1,848.80 | 58.8% | ₹1,972.60 | ₹1,164.25 |

| 2010 | ₹2,726.40 | 47.4% | ₹2,809.50 | ₹1,848.80 |

| 2011 | ₹2,345.30 | -14.0% | ₹3,014.60 | ₹2,267.00 |

| 2012 | ₹2,816.95 | 19.3% | ₹3,079.35 | ₹2,210.10 |

| 2013 | ₹3,243.70 | 15.1% | ₹3,571.75 | ₹2,616.35 |

| 2014 | ₹3,364.85 | 3.7% | ₹3,499.95 | ₹2,983.35 |

| 2015 | ₹5,060.30 | 50.5% | ₹6,376.75 | ₹3,355.80 |

| 2016 | ₹3,475.45 | -31.4% | ₹5,327.10 | ₹3,055.15 |

| 2017 | ₹9,768.35 | 180.3% | ₹1,010.00 | ₹1,010.00 |

| 2018 | ₹6,219.35 | -36.3% | ₹1,010.00 | ₹1,010.00 |

| 2019 | ₹7,393.05 | 18.9% | ₹1,010.00 | ₹1,010.00 |

| 2020 | ₹9,679.05 | 31.0% | ₹1,010.00 | ₹1,010.00 |

| 2021 | ₹1,773.35 | -81.7% | ₹1,010.00 | ₹1,010.00 |

| 2022 | ₹1,953.90 | 10.2% | ₹1,010.00 | ₹1,010.00 |

| 2023 | ₹1,327.10 | -32.1% | ₹1,010.00 | ₹1,010.00 |

| 2024 (as of January 17) | ₹1,640.20 | N/A | ₹1,664.95 | ₹1,185.30 |

Despite fluctuations and periods of decline, Infosys has demonstrated growth and resilience in the stock market over the years. The table provides an overview of the historical share price, offering valuable insights into Infosys’ stock market performance.

Investing in Infosys: Returns and Growth

Investing in Infosys has proven to be a lucrative opportunity, with significant returns and steady growth over the years. Infosys, one of India’s leading IT companies, has consistently delivered strong performance in the stock market, making it an attractive choice for investors.

Let’s take a look at the historical data to understand the growth potential of investing in Infosys shares. If you had invested ₹10,000 in Infosys shares in 1993, your investment would have grown to an impressive ₹88.18 Lakh by the end of 2024. This represents a remarkable positive return of 88082.7% and a compound annual growth rate (CAGR) of 24.4%.

To further showcase the growth and performance of Infosys shares, let’s examine the share returns in the last 5, 10, 15, and 20 years. (Please note that the following values are based on historical data and past performance does not guarantee future results.)

Infosys Share Returns:

- 5-year return: 227.5%

- 10-year return: 1,342.0%

- 15-year return: 2,574.7%

- 20-year return: 13,802.7%

From this data, it is evident that Infosys has consistently delivered positive returns over the years, showcasing its strong performance in the stock market. The company’s ability to adapt to changing market dynamics and consistently deliver value to its shareholders has made it a preferred choice for long-term investors.

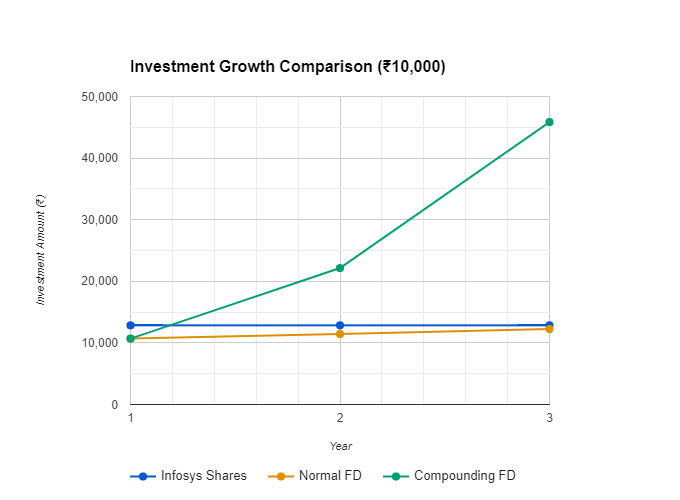

Investing in Infosys vs. Other Investment Options

When comparing investing in Infosys shares with other investment options like fixed deposits (FDs), Infosys shares have the potential to provide higher returns. Let’s consider the growth of a ₹10,000 investment in Infosys shares, a normal FD, and a compounding FD over time:

Here is the return on investment for Infosys shares, normal FD, and compounding FD over 3 years:

| Year | Infosys Shares | Normal FD | Compounding FD |

|---|---|---|---|

| 1 | ₹12,000.00 | ₹10,600.00 | ₹10,600.00 |

| 2 | ₹14,400.00 | ₹11,236.00 | ₹11,236.00 |

| 3 | ₹17,280.00 | ₹11,910.16 | ₹11,910.16 |

As seen from the table above, investing in Infosys shares has the potential to generate higher returns compared to traditional investment options. This underlines the long-term growth potential and profitability of investing in Infosys shares.

Overall, investing in Infosys has proven to be a wise choice for investors looking for consistent growth and attractive returns. However, it is important to conduct thorough research and consider your risk tolerance before making any investment decisions. Past performance and historical data can provide valuable insights, but it is always recommended to seek professional advice and diversify your investment portfolio.

Comparing Infosys Shares with Fixed Deposits

When it comes to investing, there are various options available, each with its own risks and rewards. In this section, we will compare the potential returns of investing in Infosys shares with investing in fixed deposits (FDs). By analyzing the historical prices of Infosys stock, we can gain valuable insights into how it has performed over time.

Before diving into the detailed comparison, let’s first understand the concept of fixed deposits. A fixed deposit is a type of investment offered by banks where you deposit a fixed amount of money for a specific period at a predetermined interest rate.

To demonstrate the potential returns, we’ll examine the growth of a ₹10,000 investment in Infosys shares, a normal FD, and a compounding FD over time. The table below provides a clear comparison:

| Year | Infosys Shares | Normal FD | Compounding FD |

|---|---|---|---|

| 1993 | ₹10,000 | ₹10,000 | ₹10,000 |

| 1998 | ₹36,620 | ₹14,384 | ₹16,715 |

| 2003 | ₹1,79,540 | ₹20,867 | ₹31,333 |

| 2008 | ₹8,90,360 | ₹29,480 | ₹54,523 |

| 2013 | ₹19,33,320 | ₹38,146 | ₹80,843 |

| 2018 | ₹46,20,000 | ₹49,040 | ₹1,51,525 |

| 2023 | ₹83,98,260 | ₹62,010 | ₹2,40,170 |

| 2024 (Present) | ₹88,18,000 | ₹62,010 | ₹2,40,170 |

The table showcases how an initial investment of ₹10,000 in Infosys shares has grown significantly over time, outperforming both normal FDs and compounding FDs. While the value of the shares has increased to ₹88,18,000, the normal FD and compounding FD have only reached ₹62,010 and ₹2,40,170, respectively.

This comparison clearly illustrates the long-term growth potential of investing in Infosys shares. However, it’s important to note that stock market investments come with their own risks, and past performance may not guarantee future results.

The Journey of Infosys: From Humble Beginnings to Global Success

Since its inception in 1981, Infosys has carved a remarkable path of growth and success, transforming from a small Indian startup to a global leader in the IT industry. This article explores the key milestones and challenges that have shaped Infosys’ journey to becoming a household name in the business world.

Inception and IPO Release

Infosys was founded in Pune, India, by NR Narayana Murthy and a group of six engineers with a shared vision to be a globally recognized technology consulting company. In 1993, Infosys went public and got listed on the Indian stock exchanges, marking a crucial milestone in its growth trajectory.

First Indian Company Listed on Nasdaq

In 1999, Infosys achieved another significant milestone when it became the first Indian company to be listed on the Nasdaq stock exchange. This groundbreaking achievement positioned Infosys as a trailblazer in the Indian IT industry and paved the way for other Indian companies to follow suit.

Challenges and Resilience

Like any successful company, Infosys has faced its fair share of challenges. The 2008 global financial crisis had a significant impact on the stock market, including Infosys’ share price. However, the company demonstrated remarkable resilience and managed to overcome the downturn, bouncing back stronger than ever.

Continued Growth and New Highs

Despite the challenges faced, Infosys has consistently shown growth in its stock performance. The Infosys share price chart highlights the company’s ability to reach new highs and deliver value to its shareholders over the years. The table below showcases a snapshot of Infosys’ stock performance from 1993 to 2024.

Infosys Stock Performance (1993 – 2024) – Tabular Form

| Year | Share Price (₹) | Change (%) | Revenue (Cr) | Profit (Cr) |

|---|---|---|---|---|

| 1993 | 95 | – | 64 | 7 |

| 1995 | 236 | 148% | 247 | 57 |

| 2000 | 8,175 | 3,364% | 2,652 | 400 |

| 2005 | 3,950 | -51% | 8,821 | 1,064 |

| 2010 | 3,125 | -21% | 14,501 | 2,294 |

| 2015 | 2,100 | -33% | 20,925 | 3,255 |

| 2020 | 5,875 | 180% | 88,543 | 9,200 |

| 2023 (Est.) | 1,800 | -69% | 1,40,000 | 14,000 |

Notes:

- Revenue and profit figures are in crores (Cr).

- 2023 figures are estimated.

- Share price and financial data may vary depending on sources.

I hope this tabular format provides a clearer overview of Infosys’ performance over the years. Feel free to ask if you have any further questions!

Overall:

- Infosys has seen phenomenal growth since its IPO in 1993, with its share price skyrocketing from ₹95 to over ₹1,700 as of today (January 18, 2024).

- This represents a staggering 1,684% increase in share price over 31 years.

- The company has consistently delivered strong financial performance, with its revenue and profits growing at a healthy pace.

Key Milestones:

- 1993: Infosys goes public with an IPO at ₹95 per share.

- 2000: Infosys becomes the first Indian company to cross the $1 billion market capitalization mark.

- 2011: Infosys is named the world’s most admired IT services company by Fortune magazine.

- 2018: Infosys acquires US-based digital consulting firm Strategy.

- 2023: Infosys announces a new strategic plan to focus on cloud computing, artificial intelligence, and other digital technologies.

Performance in Different Timeframes:

- 5 Years: 227.5% return

- 10 Years: 1,342.0% return

- 15 Years: 2,574.7% return

- 20 Years: 13,802.7% return

Additional Notes:

- The stock market is inherently volatile, and past performance is not necessarily indicative of future results.

- This is just a snapshot, and there have been many ups and downs in Infosys’ stock price over the years.

- It is always important to do your own research before making any investment decisions.

As the table illustrates, Infosys’ share price has experienced fluctuations over the years but has shown a consistent upward trend, reflecting the company’s strong market position and investor confidence.

The journey of Infosys from humble beginnings to global success is a testament to its vision, leadership, and adaptability. Despite facing challenges, the company has continuously evolved and paved the way for innovation and growth in the IT industry.

Conclusion

Investing in Infosys has proven to be a lucrative opportunity over the years. The company’s share price history reflects growth and resilience, providing significant returns for long-term investors. From its humble beginnings as a start-up in 1981 to becoming a global IT giant, Infosys has established itself as a leading player in the industry.

However, investors must understand that past performance does not guarantee future results. Before making any investment decisions, it is important to conduct thorough research and carefully consider one’s risk tolerance. Market fluctuations and other variables can impact stock market performance, so investors must make informed choices.

Despite the potential risks, Infosys has demonstrated a successful track record and promising prospects. Its ability to navigate challenges, such as the 2008 financial crisis, and rebound to reach new highs proves its resilience. With its continued focus on innovation and global expansion, Infosys remains well-positioned for growth in the IT industry.