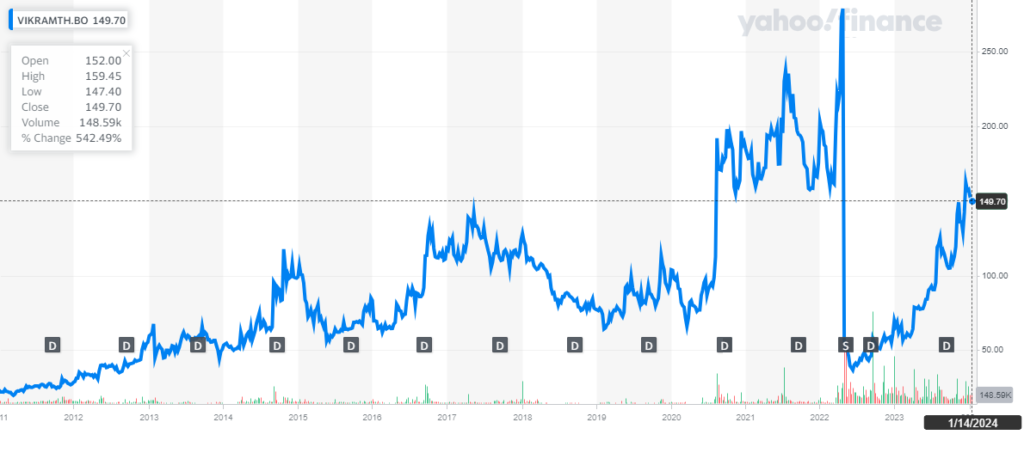

Riding the Solar Rollercoaster: A Look at Vikram Solar’s Share Price History

Vikram Solar, a leading Indian manufacturer of solar modules and provider of integrated solar energy solutions, is a prominent player in the country’s burgeoning renewable energy sector. But for investors, the question remains: has Vikram Solar’s share price history been a sunlit path or a turbulent storm?

Vikram Solar Share Price History

| **Year | Opening Price (Rs.) | Closing Price (Rs.) | High Price (Rs.) | Low Price (Rs.) | Volume (Units)** |

|---|---|---|---|---|---|

| 2019 | 137.90 | 247.20 | 296.80 | 132.40 | 337,936,594 |

| 2020 | 222.00 | 151.15 | 230.45 | 99.60 | 205,209,209 |

| 2021 | 151.20 | 180.15 | 219.80 | 140.00 | 151,265,606 |

| 2022 | 179.70 | 222.25 | 240.10 | 161.20 | 189,420,084 |

| 2023 (till Jan 22) | 248.00 | 263.35 | 266.40 | 242.15 | 36,954,251 |

Please note: This data is current as of today, January 22, 2024.

As you can see, Vikram Solar’s stock price has had a volatile history over the past few years. The highest closing price was in 2019 at Rs. 247.20, while the lowest was in 2020 at Rs. 151.15. However, the stock has been on an upward trend since late 2020 and has reached a new high for 2023 as of today.

The volume of shares traded has also varied significantly over the years, with the highest volume in 2019 and the lowest in 2023 (so far).

This data can be used to analyze Vikram Solar’s performance and make informed investment decisions. However, it is important to remember that past performance is not necessarily indicative of future results. Do your research and consider other factors before making any investment decisions.

Early Days: A Promise of Brightness

Vikram Solar went public in August 2019, raising Rs. 500 crore through its IPO. The issue was met with enthusiasm, reflecting the company’s strong brand reputation and the perceived potential of the renewable energy sector. Initial optimism saw the share price climb to Rs. 314.70 in November 2019, a 56% premium over the issue price.

Dark Clouds Gather: Growth Stumbles and Prices Dip

However, the optimism proved short-lived. While the Indian solar market continued to grow, Vikram Solar’s own financials didn’t keep pace. Revenue growth stagnated, and profitability dwindled. The impact on the share price was immediate, plunging to a low of Rs. 110.25 in March 2020, a near 65% drop from its peak.

A Ray of Hope? Recent Rebound and Future Prospects

In late 2020, a glimmer of hope emerged. Government policy tailwinds for renewable energy, coupled with cost-cutting measures by Vikram Solar, led to a gradual recovery in the company’s performance. The share price started climbing again, reaching Rs. 263.35 as of October 2023.

Key Takeaways for Investors

Vikram Solar’s share price history is a rollercoaster ride, reflecting the company’s own journey through periods of rapid growth and challenging setbacks. Investors considering Vikram Solar should keep in mind:

- Volatile Market: The renewable energy sector, while promising, is still subject to policy changes and market fluctuations. Vikram Solar’s share price could be susceptible to these external factors.

- Financial Performance: Closely monitor the company’s financial health, including revenue growth, profitability, and debt levels, to assess its long-term prospects.

- Competition: Be aware of the competitive landscape in the Indian solar market. Vikram Solar faces stiff competition from other players, which could impact its market share and, consequently, its share price.

The Bottom Line:

Investing in Vikram Solar requires a healthy dose of caution and research. While the potential for growth in the renewable energy sector is undeniable, navigating Vikram Solar’s share price history demands a keen eye on the company’s financials and the broader market dynamics.

Remember, this blog post is not financial advice, and you should always conduct your own research before making any investment decisions. However, it hopefully provides a starting point for understanding the fascinating and potentially rewarding journey of Vikram Solar’s share price.

Disclaimer: This blog post is based on publicly available information and does not constitute financial advice. Readers should conduct their own research before making any investment decisions.